Real Estate Breakdown – November 2022

Unless your current residence is under a rock you have heard that there has been a change in the real estate market. We want to provide some wisdom for you to decipher and get actionable education from all of the information available.

- Rates Increase

o The FED doesn’t set the mortgage rates but they set the Fed Fund Rate (rate for banks to borrow money) and they manipulate it to stabilize prices and maximize employment or simply to balance the economy.

o Currently the FED Fund Rate is 3.75% to 4.0% while 30-year Fixed Mortgage rate is about 6.875%. So, the Fed Fund Rate isn’t directly the Mortgage Rate for borrowers.

o They use historical knowledge and economic data to know when and how much to adjust the Fed Fund Rate. The issue I think here is that the pandemic (COVID-19) is a new influencer to the system and how the traditional tools function may be influenced like never before. We’ve never seen such a lockdown and then a national migration shift because of the aftermath of the pandemic.

o Fed held rates near 0% in 2020 with two emergency meetings in March of 2020 and in that month the FED Fund Rate dropped 150 basis points. There wasn’t nearly as much media coverage over that as there was the Pandemic & supply chain shortages (remember toilet paper Armageddon) & the scare of becoming ill or dying of COVID. Now they have raised the rate dramatically with four consecutive 75 basis point increases to get the rate (that is 300 basis points increase in 4 months).

o This impacted mortgage bankers to raise mortgage rates steeply. How steep? Well in Nov 2021 rates were 3.23% and in Nov 2022 they are 6.62% and they are extremely volatile as the changes were so steep and sudden.

o Don’t believe all the memes you see in the Meta space about how little impact the rate will have on your mortgage payments. Check the math for yourself and trust specialists in person with your circumstances. There is social media hype about Marry the Home and Date the rate. Well, you would not take your date out for caviar and $300 bottles of wine if that is not in your budget so the analogy is a bit misleading. If you can’t afford it, it doesn’t matter if you can divorce the rate (refi) later. Mortgage lenders are doing what they can to increase the loan applications in the pipeline and you need to do the math and make plans for what fits your situation.

o Many are calling for rates to fall next Spring and with low inventory to see another buying frenzy. That could happen but we have more inventory leading into this Spring than we did coming out of the Pandemic when sellers feared letting people into their homes, so it will not likely be as severe as this summer.

- Inventory Increase

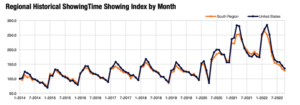

o Because the average 30-year fixed rate has been below 5% since early 2010, many buyers have never seen rates this high. Buyers paused their moves, so see what would happen in both housing (prices) and employment (do they still. Have a job).

o A lot of employment and revenue is generated from housing sales and construction and as the rates went up the sales slowed down in housing and jobs were lost (quickly too).

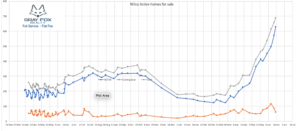

o Mid May we started feeling the increase in inventory in Middle TN. Increase started in March but in May it finally exceeded the Pandemic low levels.

o Inventory is still below what is needed and below what we would have seen in a market that was more stable like January 2016 (there were 1410 units in Williamson County for sale). This is good news for sellers as when rates drop and buyer re-engage in the market there could be a frenzy again for the available properties but nothing like 2021 and early 2022, as now we have 5 times the inventory that we had then.

o Showings decreased rapidly in May 2022 thus future sales volumes followed.

- Affordability issues

o Median home price went to $450,000 and that is 2.5 times the median price the last time that the average 30-year fixed mortgage rate was 7% (back in 2001). Chart of Rate vs Media Price

o With new construction contracts written during a period of low mortgage rates builders face higher than usual cancellation rates. One of the largest national builders reported Q3 fallout of 32% vs 19% for same period in 2021. This adds to inventory. This could create more inventory to get us back to a stable level of inventory.

o Casual buyers sit idle on the sidelines watching prices slide awaiting the rates to decline.

- Prices Decease

o Simple supply and demand would dictate that this increase in supply will bring prices down. For sure as the increased supply is available buyers have options, less competing offers so they can negotiate and we have seen it reduce sales prices.

o Not a dramatic reduction but a decline none the less. However, a reduction of 10% or even 15% will not be bad for most after a 45% increase over the past year. We are not talking Crash we are talking Correction in pricing.

Many of these topics are discussed with these graphics on our Facebook page and Insta page so follow us there to get our insights of the market.

If you want to know more about the local market please reach out to us at Gray Fox Realty via email at info@grayfoxrealty.com or at 615-656-8181.

Recent Comments